BOOTCAMP Credit Risk Modelling Gold

CREDIT RISK MODELLING [175 hours]

| Sn | Topics | |

| Basic Understanding | ||

| 01 | Understanding Loan Lifecycle | |

| 02 | Scorecards vs Basel vs IFRS9 vs CCAR models | |

| 03 | Excel hands - on – Data Preparation for Model development | |

| Scorecards | ||

| 01 | Application Scorecard vs Behavioural Scorecard | |

| 02 | Understanding Bad definition | |

| 03 | Excel hands-on - Roll Rate Analysis (to incorporate bad flag) on Fannie Mae Mortgage data | |

| 04 | Understanding concepts of Snapshot, Observation Period & Performance Period | |

| 05 | Excel hands-on - Seasoning analysis to identify Performance Window | |

| 06 | Thinking beyond Statistics - Policy rules, Overrides, Reject Inferencing | |

| 07 | Excel hands - on – Building Application Scorecards using Logistic Regression | |

| 08 | Excel hands - on – Building Behavioural Scorecards using Logistic Regression | |

| Loss Modelling | ||

| 01 | Excel hands - on - Modelling Losses through Vintage analysis | |

| 02 | Excel hands - on – Modelling Losses using Flow Rate Approach | |

| Modelling Probability of Default | ||

| 01 | Excel hands-on -Calculating PD using Logistic Regression | |

| 02 | Calculating PD using Machine Learning Techniques | |

| 03 | PD segmentation using Decision trees | |

| Modelling Loss given Default | ||

| 01 | Calculating workout LGD (Excel) | |

| 02 | Tobit & Beta Regression for LGD Modelling (Excel) | |

| 03 | Fractional Logistic Regression for LGD Modelling (Excel) | |

| 04 | Incomplete workout approach (Excel) | |

| Modelling Exposure at Default | ||

| 01 | Modelling EAD using CCF (Excel) | |

| 02 | CCF calculation using Fixed & Variable Horizon, Cohort approach (Excel) | |

| 03 | CCF Regression (Excel) | |

| Cure Modelling | ||

| 01 | Instant Cure vs Probationary Cure (Model design) | |

| 02 | Loss given Cure modelling | |

| Basel Capital Charge | ||

| 01 | RWA & Capital Adequacy Ratio calculations (Excel) | |

| 02 | Using Vasicek formula to convert TTC PD to Worst Case PD | |

| 03 | Calculating Capital as per Basel IRB Approach (Excel) | |

| IFRS 9 Introduction | ||

| 01 | TTC PD in Basel vs PIT PD in IFRS | |

| 02 | 12 months PD calculation vs lifetime PD calculation | |

| 03 | Understanding Concepts of Staging – Stage 1| Stage 2 | Stage 3 | |

| IFRS 9 PD Calculation | ||

| 01 | Understanding Conditional PD Vs Unconditional PD | |

| 02 | Excel hands-on – Converting TTC PD to PIT PD using Z score | |

| 03 | Excel hands-on – Converting TTC PD to PIT PD using Log Odds shift | |

| 04 | Excel hands-on – Converting TTC PD to PIT PD using Scalar approach | |

| 05 | Calibration & Smoothening techniques (Excel) | |

| CECL techniques | ||

| 01 | Discrete Time Hazard Models (Excel) | |

| 02 | Snapshot/Open Pool Method | |

| 03 | WARM Model (Excel) | |

| 04 | Vintage analysis (Excel) | |

| Actuarial Credit Risk Models | ||

| 01 | Survival analysis (Excel) | |

| 02 | Lee Carter Model (Excel) | |

| 03 | Age Period Cohort Analysis (Excel) | |

| APC Extensions | ||

| 01 | Validating APC - Alternating Vintage Diagrams, Moran's D (Excel) | |

| 02 | Bayesian APC (Excel) | |

| 03 | Quantifying Adverse Selection by Vintage (Excel) | |

| 04 | Adverse Selection through Fixed and Random effects (Excel) | |

| IFRS 9 LGD & EAD Calculation | ||

| 01 | PIT forward looking term structure of LGD as a function of Collateral value (Excel) | |

| 02 | PIT forward looking term structure of LGD using Regression (Excel) | |

| 03 | Calculating PIT LGD using Jacob Frye model (Excel) | |

| 04 | CCF Term structure using Regression (Excel) | |

| IFRS 9 Wholesale Models | ||

| 01 | Understanding Transition Matrices | |

| 02 | Building Transition Matrix using Cohort Approach (Excel) | |

| 03 | Building Transition Matrix using Duration Approach (Excel) | |

| 04 | Converting TTC Transition Matrix to PIT Transition matrix (Excel) | |

| 05 | Validating Transition Matrices (Excel) | |

| Low Default Portfolios | ||

| 01 | Bayesian approach to handle LDP (Excel) | |

| 02 | Pluto Tasche Approach (Excel) | |

| 03 | Van Der Burgt Method (Excel) | |

| 04 | QMM Method (Excel) | |

| Stress Testing | ||

| 01 | Top Down vs Bottom Up stress Testing (Excel) | |

| 02 | ICAAP | |

| 03 | Understandings CCAR vs DFAST requirements | |

| 04 | PPNR Modelling | |

| 05 | Excel hands -on – Modelling ARIMA & ARIMAX | |

| 06 | Excel hands -on – Building CCAR & PPNR model using multiple regression & time series models | |

| 06 | Excel hands – on – Perform 9 quarter In Sample & Out of Sample Backtesting | |

| 07 | Backtesting & Benchmarking | |

| Model Validation | ||

| 01 | Evaluating Discriminatory Power Of Model (Excel) | |

| 02 | Evaluating Accuracy of Model and Calibration (Excel) | |

| 03 | Performing Stability analysis (Excel) | |

| 04 | Margin of Conservatism (Excel) | |

| 05 | Validating Wholesale Models (Excel) | |

| 06 | Validating Stress Testing Models (Excel) | |

| Pricing Loans | ||

| 01 | Optimizing Yields using Solver (Excel) | |

| 02 | RAROC based pricing (Excel) | |

| Corporate Credit Models | ||

| 01 | Merton & KMV Models (Excel) | |

| 02 | Credit Plus Models (Excel) | |

| 03 | Credit Portfolio View (Excel) | |

| 04 | Credit Metrics Model (Excel) | |

| Advanced Econometrics Example | ||

| 01 | Bayesian Regression Models (Excel) | |

| 02 | Kalman Regression Models (Excel) | |

| 03 | Generalized Additive Models (Excel) |

ABOUT THE TRAINER

Karan is a highly skilled & knowledgeable Corporate trainer with 5+ years of total work experience spanning across Financial Modelling & Data Analytics. Known for having a knack for problem solving, thought leadership, highly analytical mindset, intrapreneurship, solid fundamentals & learning aptitude. Spearheaded several solution accelerators and spreadsheet based prototypes in Risk and Analytics space.

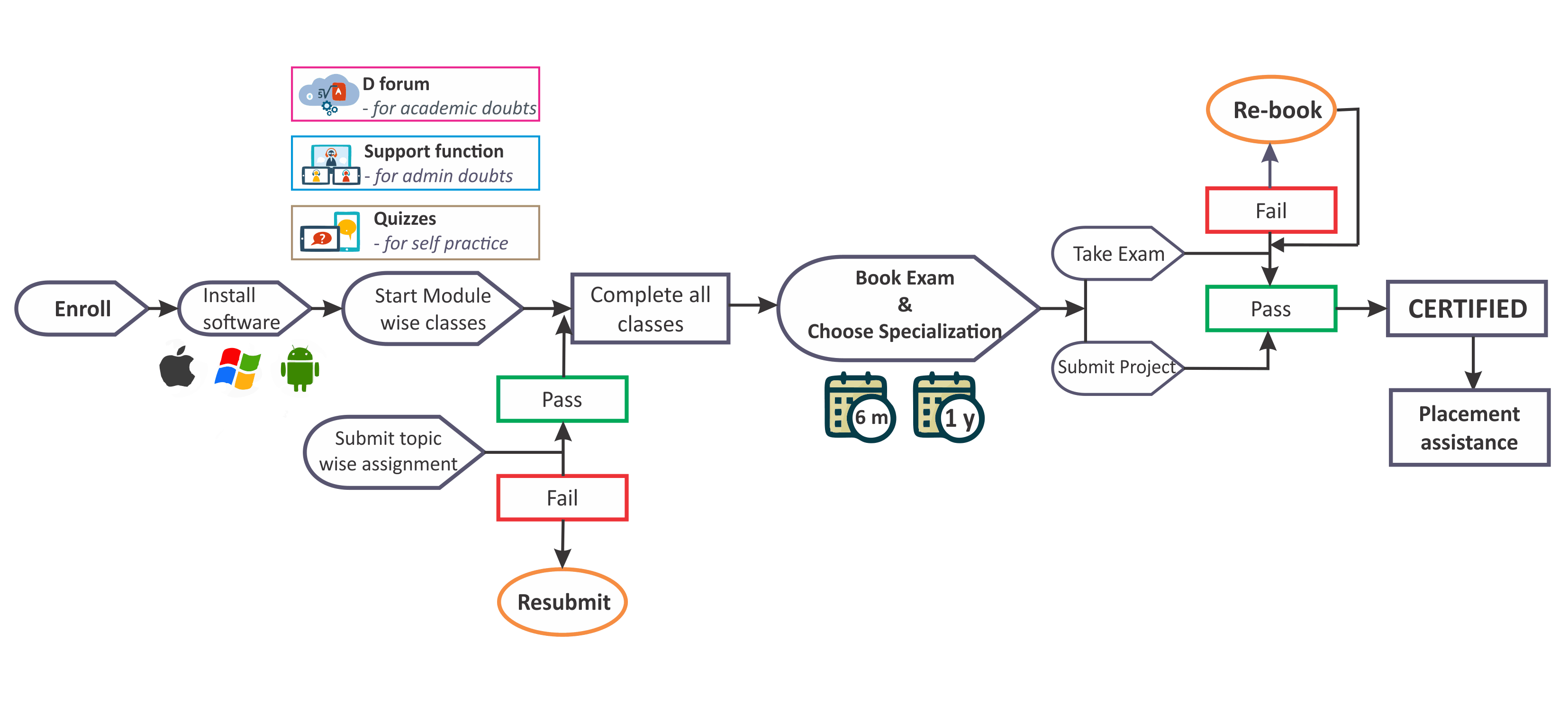

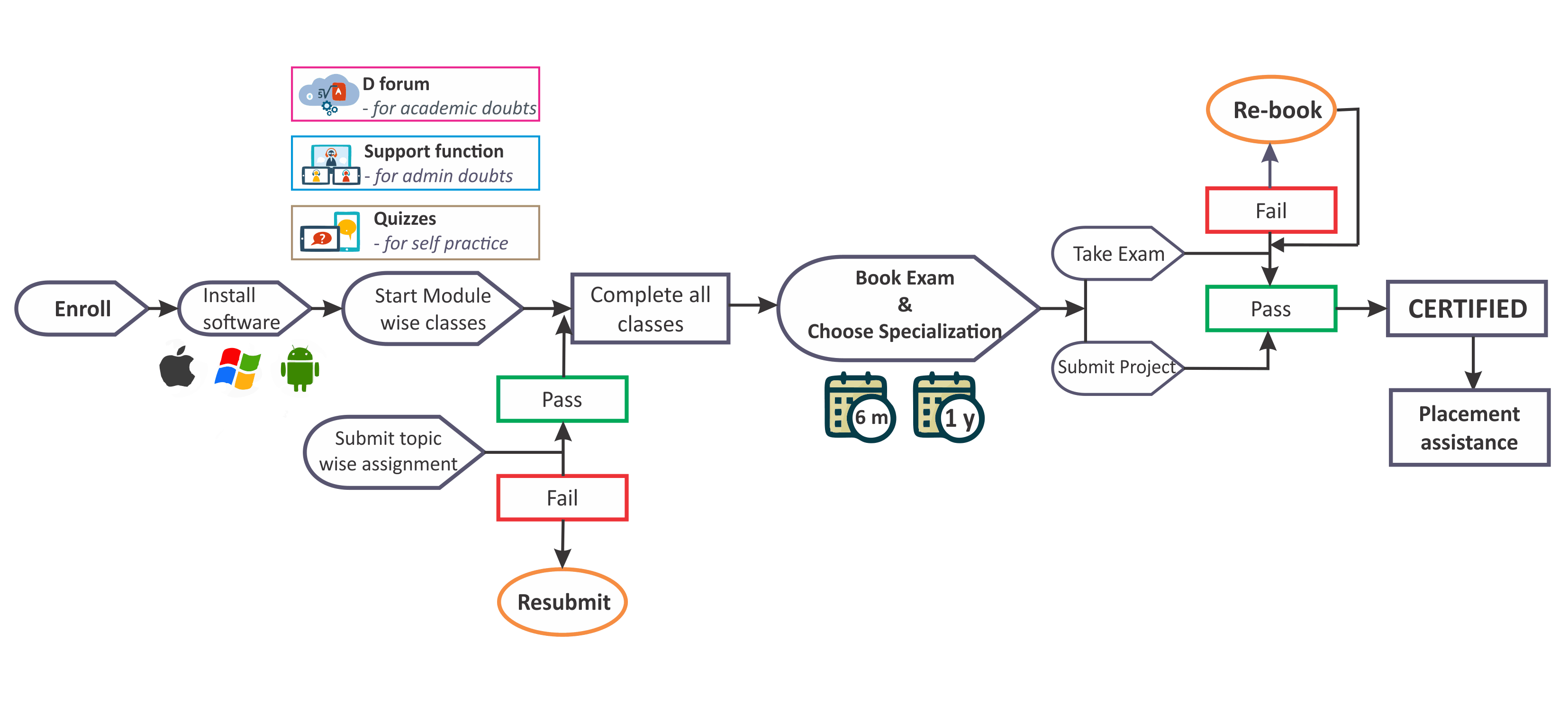

Ans 1. Anyone with finance/CA/CFA/FRM/Engineering Background can join this program. Basic knowledge of statistics is recommended but not compulsory

Ans 2. Credit risk modelling doesn't require very advanced level of maths. Also the entire program is taught in Excel & Python to facilitate easy understanding of all models.

Ans 3. It is a 100% practical program with dozens of case studies and spreadsheet models. The approach of delivering the concepts is application based to make you a right fit for credit risk consulting.

Ans 4. To get certificates you need to complete all topic wise assignments, final project and pass the MCQ based exam.

Ans 5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans 6. With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans 7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans 8. You can schedule your exams anytime after course completion but before the expiration of validity.

Ans 9. Every class is supported by one note files, excel sheets and reading material. All these are available in the course section only.

Ans 10. Letter of Recommendation is physically delivered within 60 days of passing the exam. LOR’s also mention the details of the final project completed to avail the certificate.

CREDIT RISK MODELLING [175 hours]

| Sn | Topics | |

| Basic Understanding | ||

| 01 | Understanding Loan Lifecycle | |

| 02 | Scorecards vs Basel vs IFRS9 vs CCAR models | |

| 03 | Excel hands - on – Data Preparation for Model development | |

| Scorecards | ||

| 01 | Application Scorecard vs Behavioural Scorecard | |

| 02 | Understanding Bad definition | |

| 03 | Excel hands-on - Roll Rate Analysis (to incorporate bad flag) on Fannie Mae Mortgage data | |

| 04 | Understanding concepts of Snapshot, Observation Period & Performance Period | |

| 05 | Excel hands-on - Seasoning analysis to identify Performance Window | |

| 06 | Thinking beyond Statistics - Policy rules, Overrides, Reject Inferencing | |

| 07 | Excel hands - on – Building Application Scorecards using Logistic Regression | |

| 08 | Excel hands - on – Building Behavioural Scorecards using Logistic Regression | |

| Loss Modelling | ||

| 01 | Excel hands - on - Modelling Losses through Vintage analysis | |

| 02 | Excel hands - on – Modelling Losses using Flow Rate Approach | |

| Modelling Probability of Default | ||

| 01 | Excel hands-on -Calculating PD using Logistic Regression | |

| 02 | Calculating PD using Machine Learning Techniques | |

| 03 | PD segmentation using Decision trees | |

| Modelling Loss given Default | ||

| 01 | Calculating workout LGD (Excel) | |

| 02 | Tobit & Beta Regression for LGD Modelling (Excel) | |

| 03 | Fractional Logistic Regression for LGD Modelling (Excel) | |

| 04 | Incomplete workout approach (Excel) | |

| Modelling Exposure at Default | ||

| 01 | Modelling EAD using CCF (Excel) | |

| 02 | CCF calculation using Fixed & Variable Horizon, Cohort approach (Excel) | |

| 03 | CCF Regression (Excel) | |

| Cure Modelling | ||

| 01 | Instant Cure vs Probationary Cure (Model design) | |

| 02 | Loss given Cure modelling | |

| Basel Capital Charge | ||

| 01 | RWA & Capital Adequacy Ratio calculations (Excel) | |

| 02 | Using Vasicek formula to convert TTC PD to Worst Case PD | |

| 03 | Calculating Capital as per Basel IRB Approach (Excel) | |

| IFRS 9 Introduction | ||

| 01 | TTC PD in Basel vs PIT PD in IFRS | |

| 02 | 12 months PD calculation vs lifetime PD calculation | |

| 03 | Understanding Concepts of Staging – Stage 1| Stage 2 | Stage 3 | |

| IFRS 9 PD Calculation | ||

| 01 | Understanding Conditional PD Vs Unconditional PD | |

| 02 | Excel hands-on – Converting TTC PD to PIT PD using Z score | |

| 03 | Excel hands-on – Converting TTC PD to PIT PD using Log Odds shift | |

| 04 | Excel hands-on – Converting TTC PD to PIT PD using Scalar approach | |

| 05 | Calibration & Smoothening techniques (Excel) | |

| CECL techniques | ||

| 01 | Discrete Time Hazard Models (Excel) | |

| 02 | Snapshot/Open Pool Method | |

| 03 | WARM Model (Excel) | |

| 04 | Vintage analysis (Excel) | |

| Actuarial Credit Risk Models | ||

| 01 | Survival analysis (Excel) | |

| 02 | Lee Carter Model (Excel) | |

| 03 | Age Period Cohort Analysis (Excel) | |

| APC Extensions | ||

| 01 | Validating APC - Alternating Vintage Diagrams, Moran's D (Excel) | |

| 02 | Bayesian APC (Excel) | |

| 03 | Quantifying Adverse Selection by Vintage (Excel) | |

| 04 | Adverse Selection through Fixed and Random effects (Excel) | |

| IFRS 9 LGD & EAD Calculation | ||

| 01 | PIT forward looking term structure of LGD as a function of Collateral value (Excel) | |

| 02 | PIT forward looking term structure of LGD using Regression (Excel) | |

| 03 | Calculating PIT LGD using Jacob Frye model (Excel) | |

| 04 | CCF Term structure using Regression (Excel) | |

| IFRS 9 Wholesale Models | ||

| 01 | Understanding Transition Matrices | |

| 02 | Building Transition Matrix using Cohort Approach (Excel) | |

| 03 | Building Transition Matrix using Duration Approach (Excel) | |

| 04 | Converting TTC Transition Matrix to PIT Transition matrix (Excel) | |

| 05 | Validating Transition Matrices (Excel) | |

| Low Default Portfolios | ||

| 01 | Bayesian approach to handle LDP (Excel) | |

| 02 | Pluto Tasche Approach (Excel) | |

| 03 | Van Der Burgt Method (Excel) | |

| 04 | QMM Method (Excel) | |

| Stress Testing | ||

| 01 | Top Down vs Bottom Up stress Testing (Excel) | |

| 02 | ICAAP | |

| 03 | Understandings CCAR vs DFAST requirements | |

| 04 | PPNR Modelling | |

| 05 | Excel hands -on – Modelling ARIMA & ARIMAX | |

| 06 | Excel hands -on – Building CCAR & PPNR model using multiple regression & time series models | |

| 06 | Excel hands – on – Perform 9 quarter In Sample & Out of Sample Backtesting | |

| 07 | Backtesting & Benchmarking | |

| Model Validation | ||

| 01 | Evaluating Discriminatory Power Of Model (Excel) | |

| 02 | Evaluating Accuracy of Model and Calibration (Excel) | |

| 03 | Performing Stability analysis (Excel) | |

| 04 | Margin of Conservatism (Excel) | |

| 05 | Validating Wholesale Models (Excel) | |

| 06 | Validating Stress Testing Models (Excel) | |

| Pricing Loans | ||

| 01 | Optimizing Yields using Solver (Excel) | |

| 02 | RAROC based pricing (Excel) | |

| Corporate Credit Models | ||

| 01 | Merton & KMV Models (Excel) | |

| 02 | Credit Plus Models (Excel) | |

| 03 | Credit Portfolio View (Excel) | |

| 04 | Credit Metrics Model (Excel) | |

| Advanced Econometrics Example | ||

| 01 | Bayesian Regression Models (Excel) | |

| 02 | Kalman Regression Models (Excel) | |

| 03 | Generalized Additive Models (Excel) |

Karan is a highly skilled & knowledgeable Corporate trainer with 5+ years of total work experience spanning across Financial Modelling & Data Analytics. Known for having a knack for problem solving, thought leadership, highly analytical mindset, intrapreneurship, solid fundamentals & learning aptitude. Spearheaded several solution accelerators and spreadsheet based prototypes in Risk and Analytics space.

Ans 1. Anyone with finance/CA/CFA/FRM/Engineering Background can join this program. Basic knowledge of statistics is recommended but not compulsory

Ans 2. Credit risk modelling doesn't require very advanced level of maths. Also the entire program is taught in Excel & Python to facilitate easy understanding of all models.

Ans 3. It is a 100% practical program with dozens of case studies and spreadsheet models. The approach of delivering the concepts is application based to make you a right fit for credit risk consulting.

Ans 4. To get certificates you need to complete all topic wise assignments, final project and pass the MCQ based exam.

Ans 5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans 6. With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans 7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans 8. You can schedule your exams anytime after course completion but before the expiration of validity.

Ans 9. Every class is supported by one note files, excel sheets and reading material. All these are available in the course section only.

Ans 10. Letter of Recommendation is physically delivered within 60 days of passing the exam. LOR’s also mention the details of the final project completed to avail the certificate.